by Peter Mertz, Huang Heng

AMSTERDAM, Montana, July 11 (Xinhua) -- In Amsterdam, a tiny farming community in southwest Montana, most of the 180 residents are involved in the industry in one capacity or another.

Dutch immigrants moved to the rugged area in the late 1800s to grow malting barley for the Manhattan Malting Company. Even today, the tiny town sits surrounded by a sea of farmland as far as the eye can see.

But despite its remote location and provincial ways, the talk of this little town is the trade tension between the United States and the rest of the world, including China, Canada, Mexico and the European Union.

"We feel a little bit helpless," said Kendal Walhof, who owns and runs Churchill Equipment, the biggest business in the tiny town where everyone knows everyone. "We know these tariffs are not good for our industry, plain and simple."

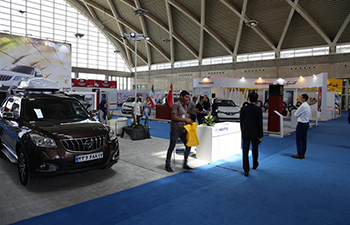

Over the past few days, Walhof and thousands of farm equipment dealers across the country have received emails and notifications from equipment suppliers that "steel is going up by 25 percent" and have to prepare accordingly.

"Ninety percent of what we sell is steel - these tariffs impact everything we sell," Walhof told Xinhua, pointing to his parking lot filled with Massey Ferguson tractors and Gehl skidsteers.

Although his early 2018 inventories escaped the price hike, Walhof knows the future will be expensive for local farmers as the new surcharge is a cost he will be forced to pass down to them. His farmer friends are getting hit on both ends of the spectrum - with increased input costs and decreased profits from their crops.

According to Dennis Slater, president of the Association of Equipment Manufacturers, America's agriculture machinery manufacturers have no choice but raising prices to offset the higher costs caused by the steel tariffs imposed by Washington.

"These harmful tariffs will directly contribute to higher steel prices, increase costs for agriculture and construction machinery, wreak havoc on the business operations of equipment manufacturers, and jeopardize many of the 1.3 million good-paying jobs our industry supports," Slater told the RealAgriculture website last month.

Pushed by the tariff on imported steel and a 10-percent tariff on aluminum imports, the prices of these materials in the United States have climbed more than 30 percent and 130 percent respectively compared to January prices.

"We've been taken advantage of ... it seems to be a scary way to go," Walhof said, worrying that President Donald Trump's trade tactics may hurt grassroot Americans more than anticipated.

"It is a global economy, and not the way it used to be," he said. "You can't just stop dealing with the world and do it on your own."

"Things are not the way they used to be," he said, adding that it is impossible today to move steel and machinery manufacturers back to the country as Trump has touted.

Down the street, Boyd Nelson's tractor had broken down in the middle of the two-lane highway. The 94-year-old slowly climbed out of his 1950 machine and cursed the 500-pound (226.79 kilogram) piece of steel.

Nelson, a farmer for 75 years, thinks that with the increased cost of steel, he may not live long enough to buy another tractor.

His friend Matt Flikkema, a farmer living in Amsterdam for 30 years, is worried about the price of farm equipment since he depends on them to make money from his 800-acre (323.74 hectare) land.

He had planted barley on a quarter of the land in a day and a half. "It's not difficult anymore to do that (with machines)," he said. "But that kind of equipment costs a lot of money. You have to replace it frequently, but we don't have better (crop) price to make that."

"Imported fertilizers, all those kind of things are gonna be impacted, I am afraid, by rising costs due to the import tariffs," he added.

Walhof, who has been running the tractor dealership for 20 years, is already anticipating a business shift to selling used equipment as a way to survive.

With an expected drop in consumer demand for new equipment, in an industry where 40,000-U.S.-dollar tractors are not uncommon, the dealer is exploring all options to stay afloat.

Ironically, his Churchill Equipment has seen above average sales in the past two months as farmers are possibly buying now rather than waiting for prices to soar.

"It seems we have to suffer before we see results," he said.

But Flikkema was less optimistic about the escalating trade tension.

"A totally unclear future," he said. "Trade is what makes our economy work and it should be free and open."?